You are now leaving the FirstLight Federal Credit Union website. The Credit Union is not responsible for the privacy practices or the content of other websites. In no event will the Credit Union be liable for problems arising from the use of the FLFCU website to link to other websites, including but not limited to computer viruses, loss of data, delay in operation, transactions conducted between the third party and the member, and transmission or loss of privacy.

Skip-a-payment is available at any time, all year round!

You may skip a payment on any qualifying loan twice within a 12-month period, with a minimum of three (3) consecutive payments between uses.

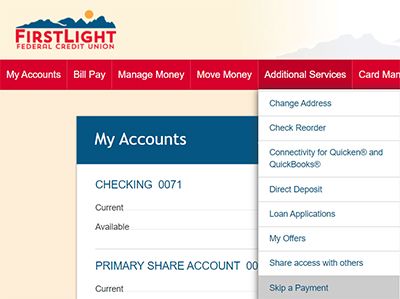

To submit a FirstLight skip-a-payment request, simply log-in to Online Banking, select the “Additional Services” tab and click on “Skip a Payment” to choose the qualifying loan and follow the prompts.

By requesting for FirstLight to skip a payment on your loan, you are agreeing to the following terms and conditions:

To qualify, skip-a-pay participation requires:

• Membership in good standing;

• Current on all loan payments;

• First skip cannot occur until 6 months after initial loan funding;

• Qualifying Auto Loan or Signature Loan;

• Must be at least 18 years of age;

• All joint account holders must meet the same criteria as the primary account holder; and

• Must have the Skip-a-Pay fee amount available in account share(s).

Disclosure (Effective 10.15.2020):

Skip-a-Pay is limited to two (2) skipped payments, within 12 months, with a minimum of three (3) consecutive payments between uses. FirstLight Federal Credit Union (FLFCU) reserves the right to refuse any Skip-a-Pay request, cancel, or modify this program at any time.

If your loan has an automatic payment transfer feature and you skip a payment,one of the following will be done depending on the type of transfer you have:

Actions you may need to take:

a) If you went into online banking and set up an automatic transfer to pay your loan from your savings or checking account, you will need to cancel your automatic transfer and set it up again with the new date.

b) If you have an ACH (Automatic Clearing House) transfer agreement at another financial institution, you will need to notify that financial institution to stop the ACH withdrawal and inquire for details on reinstating the electronic payment after the skipped month. Failure to contact the other financial institution may result in the payment being processed as scheduled. FirstLight is not responsible for starting or stopping ACH transactions originated at another financial institution or for any fees that may be incurred for overdrawn accounts or late payment fees assessed.

Actions FirstLight may need to take:

c) If a FirstLight employee set up an automatic transfer from your checking or savings account, we will not process a payment transfer until the next (new) due date on your loan.

d) If FirstLight generates an ACH (Automatic Clearing House) transfer from your account at another financial institution, we will advance the next transfer date one month forward.

The following loan types do NOT qualify for the program: Mortgage, Business, Title, Credit Cards, Solar Loans, Lines of Credit, Shared Secured, and Share Certificate Secured, and loans that are modified for financial hardship do not qualify for this service. If you are a debtor in any pending Bankruptcy proceeding, contact FLFCU for further information at (800) 351-1670.

Interest and insurance (life and disability) premiums will continue to accrue during the period when no payment is made. Skipping a payment will extend the loan’s maturity date. A fee of $25.00, per loan, per Skip-a-Pay request will be assessed and debited from your Share (Savings) or Share draft (Checking) account.

Skipped payments may not be covered by debt cancellation, GAP, or credit insurance products.